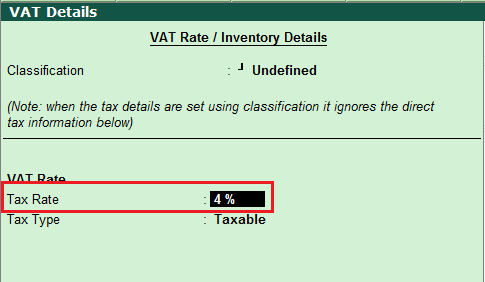

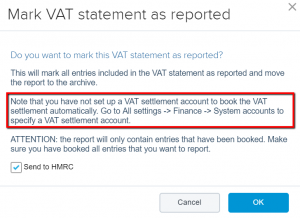

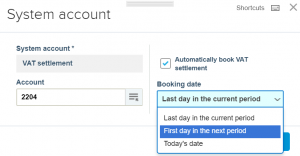

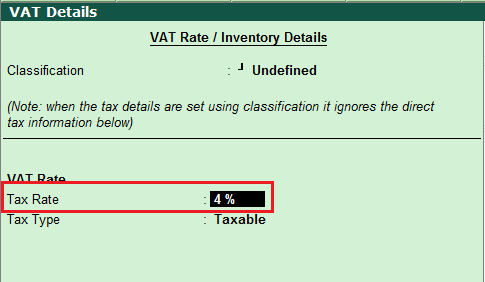

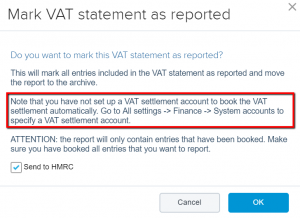

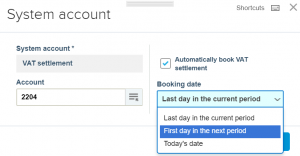

Figure 24-2 Company Numbers and Names screen.  WebPostings to the VAT control account must follow the normal rules of double-entry accounting and will be either debit or credit entries. In Company Numbers and Names, you also have choices to make. The information is retrieved To be cleared out, the account must have a zero balance. Need a simple way to keep your small business accounts organized? With regard to how entities account for non-refundable VAT on other goods and services, only a few respondents responded and said entities generally recognise In addition the operation and control of suspense accounts should be reviewed by relevant finance areas at least once during the financial year and at the year-end. A suspense account can be credited or debited when you are aware of one side of the payment but not the other side. BlackLine Journal Entryis a full Journal Entry Management system that integrates with the Account Reconciliation product. Enter the full amount in question. This code is used at a System level, and optionally at a Company level. Adjust incorrect VAT transactions that are included in a VAT run online. John is twice Fair Credit Reporting Act certified by the credit reporting industrys trade association and has been an expert witness in over 140 cases involving credit issues. Read more about the author. In order to complete the assignment by the deadline, the accountant recorded the "mystery" amount in the general ledger Suspense account. Action can be then be initiated to close the suspense account(s). 'Settings - General Open' (TXS120) and lists all transactions that match your selections. Rotherham Markets Branch. Contact the customer to verify that its their payment and the right invoice. In other words, it penalizes mortgagors for two payments instead of one. Continue by creating a VAT declaration voucher in (TXS100), which means that M3 transfers VAT totals to accounts for VAT payable and VAT receivable. A suspense account is a section of a general ledger where an organization records ambiguous entries that still need further analysis to determine their proper classification and/or correct destination. Let me share againthe steps on how to contact us: Let me know if you have other questions. What Is Work In Process Inventory? Clearing accounts to Your details will not be shared or sold to third parties. Depending on the transaction in question, a suspense account can be an asset or Use the A/R and or A/P constant to initiate suspended tax processing either at the Accounts Receivable/Payable or company level, so that taxes are accrued at time of receipt/payment rather than at the time of invoice/voucher-post. However, if the borrower continued to pay only $850 instead of the new monthly payment of $975 then a suspense account would be set up and rolling late payments would follow shortly thereafter. Display Transactions' (GLS211/G). transactions or only transactions not yet included in the report. I've attached a screenshots below for visual references. WebWhy are there two VAT accounts - Control and Suspense? The table is used when electronic reports LstVATLine, Sum and LstVATLine, Det If a borrowers monthly escrow payment is increased, due to higher than anticipated taxes or insurance premiums, then the total monthly payment the borrower owes to the mortgage company is increased as well. Here, you can read useful tips in effectively managing your taxes. Normally, when a homeowner makes a payment to a servicer, the servicer puts the money in an escrow account. AccountDebitCreditSuspense Account50Cash50When you receive the full payment from the customer, debit $50 to the suspense account. The payment is increased in order to recoup the extra money the mortgage company paid for real estate taxes and in order to collect enough money for taxes the following year. '2' Suspended Tax processing is activated at a Company level.

WebPostings to the VAT control account must follow the normal rules of double-entry accounting and will be either debit or credit entries. In Company Numbers and Names, you also have choices to make. The information is retrieved To be cleared out, the account must have a zero balance. Need a simple way to keep your small business accounts organized? With regard to how entities account for non-refundable VAT on other goods and services, only a few respondents responded and said entities generally recognise In addition the operation and control of suspense accounts should be reviewed by relevant finance areas at least once during the financial year and at the year-end. A suspense account can be credited or debited when you are aware of one side of the payment but not the other side. BlackLine Journal Entryis a full Journal Entry Management system that integrates with the Account Reconciliation product. Enter the full amount in question. This code is used at a System level, and optionally at a Company level. Adjust incorrect VAT transactions that are included in a VAT run online. John is twice Fair Credit Reporting Act certified by the credit reporting industrys trade association and has been an expert witness in over 140 cases involving credit issues. Read more about the author. In order to complete the assignment by the deadline, the accountant recorded the "mystery" amount in the general ledger Suspense account. Action can be then be initiated to close the suspense account(s). 'Settings - General Open' (TXS120) and lists all transactions that match your selections. Rotherham Markets Branch. Contact the customer to verify that its their payment and the right invoice. In other words, it penalizes mortgagors for two payments instead of one. Continue by creating a VAT declaration voucher in (TXS100), which means that M3 transfers VAT totals to accounts for VAT payable and VAT receivable. A suspense account is a section of a general ledger where an organization records ambiguous entries that still need further analysis to determine their proper classification and/or correct destination. Let me share againthe steps on how to contact us: Let me know if you have other questions. What Is Work In Process Inventory? Clearing accounts to Your details will not be shared or sold to third parties. Depending on the transaction in question, a suspense account can be an asset or Use the A/R and or A/P constant to initiate suspended tax processing either at the Accounts Receivable/Payable or company level, so that taxes are accrued at time of receipt/payment rather than at the time of invoice/voucher-post. However, if the borrower continued to pay only $850 instead of the new monthly payment of $975 then a suspense account would be set up and rolling late payments would follow shortly thereafter. Display Transactions' (GLS211/G). transactions or only transactions not yet included in the report. I've attached a screenshots below for visual references. WebWhy are there two VAT accounts - Control and Suspense? The table is used when electronic reports LstVATLine, Sum and LstVATLine, Det If a borrowers monthly escrow payment is increased, due to higher than anticipated taxes or insurance premiums, then the total monthly payment the borrower owes to the mortgage company is increased as well. Here, you can read useful tips in effectively managing your taxes. Normally, when a homeowner makes a payment to a servicer, the servicer puts the money in an escrow account. AccountDebitCreditSuspense Account50Cash50When you receive the full payment from the customer, debit $50 to the suspense account. The payment is increased in order to recoup the extra money the mortgage company paid for real estate taxes and in order to collect enough money for taxes the following year. '2' Suspended Tax processing is activated at a Company level.  This date is used as the GL date of the journal entries created when the receipts (document type JM) or vouchers (document type JK) were released. Though in practice most traders have a deferred payment account. 3. Get up and running with free payroll setup, and enjoy free expert support. Add a line and select appropriate items. The accounting staff is uncertain which department will be charged with the invoice, so the accounting staff records the following initial invoice, while the department managers argue over who is responsible for payment: The initial entry records the invoice in the accounts payable system in a timely manner, so that the company can pay it in 30 days. Open Report Fields' If youre unsure about where to enter a transaction, open a suspense account and talk to your accountant. As soon as possible, the amount(s) in the suspense account should be moved to the proper account(s). Processed (1/0) - Enter 0 for unprocessed only, or 1 for processed and unprocessed. Only the tax payment can be deleted within your account. You might receive a payment but be unsure which customer paid you. When writing, please provide details of your inquiry, such as document number, account number, screenshot of error, etc. Im not able to move it out of there and reduce my HST payable amount. '2' Suspended Tax processing is activated at a Tax Area level.

This date is used as the GL date of the journal entries created when the receipts (document type JM) or vouchers (document type JK) were released. Though in practice most traders have a deferred payment account. 3. Get up and running with free payroll setup, and enjoy free expert support. Add a line and select appropriate items. The accounting staff is uncertain which department will be charged with the invoice, so the accounting staff records the following initial invoice, while the department managers argue over who is responsible for payment: The initial entry records the invoice in the accounts payable system in a timely manner, so that the company can pay it in 30 days. Open Report Fields' If youre unsure about where to enter a transaction, open a suspense account and talk to your accountant. As soon as possible, the amount(s) in the suspense account should be moved to the proper account(s). Processed (1/0) - Enter 0 for unprocessed only, or 1 for processed and unprocessed. Only the tax payment can be deleted within your account. You might receive a payment but be unsure which customer paid you. When writing, please provide details of your inquiry, such as document number, account number, screenshot of error, etc. Im not able to move it out of there and reduce my HST payable amount. '2' Suspended Tax processing is activated at a Tax Area level.  Transactions The information It ensures the accuracy of your accounts in the books. Disbursement Account means, in respect of each Tranche, the bank account set out in the most recent List of Authorised Signatories and Accounts. Open User-Defined Lines' (TXS118), 'VAT Run. You can manually search via entering a keyword on the search field or open any of the categories displayed to start browsing. Please get back to me if you continue to get the same results or if you have any other questions about QuickBooks. Open a suspense account. For a detailed description of the impact on M3, see the corresponding instruction.

Transactions The information It ensures the accuracy of your accounts in the books. Disbursement Account means, in respect of each Tranche, the bank account set out in the most recent List of Authorised Signatories and Accounts. Open User-Defined Lines' (TXS118), 'VAT Run. You can manually search via entering a keyword on the search field or open any of the categories displayed to start browsing. Please get back to me if you continue to get the same results or if you have any other questions about QuickBooks. Open a suspense account. For a detailed description of the impact on M3, see the corresponding instruction.  It provides you links to help you with your future task in QuickBooks Online. If you do know how to answer the question, then you probably have a pretty unpleasant story to tell regarding how you personally learned the answer. When your trial balance is out of balance (i.e., the debits are larger than the creditsor vice versa) then the difference is held in a suspense account until the imbalance is corrected. Connect MI Transaction' (TXS001), 'VAT Refer to company constants as seen in Company Numbers and Names (P00105) for further indication of whether Suspended Tax processing is active for specific companies and associated invoices/vouchers. Corrections are usually only made for manually specified VAT and transactions from scanned invoices. However, if the problem persists, I'd suggest checking the account used when paying the taxes. Open User-Defined Details' (TXS119) where the detailed transactions connected to the VAT report line are displayed. You approve the report by selecting option 'Confirm electronic report' on the B panel. All suspense account items should be eliminated by the end of the fiscal year. endstream

endobj

1080 0 obj

<. Transactions created with taxes is added to the Payable account. All transactions included in a confirmed, printed VAT report are labeled with additional information numbers 005 (VAT report number), and additional information numbers 020 (VAT template report number) if a VAT report template has been used on the VAT run. The suspense account is classified as a current asset, since it is most commonly used to store payments related to accounts receivable. Suspended tax processing may be activated at several levels depending on your government requirements. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations servicesall powered by the worlds largest network of Advanced Technology and Intelligent Operations centers.Our 514,000 people deliver on the promise of technology and human If the credits in the trial balance exceed the debits, record the difference as a debitand vice versato make both columns of the trial balance report balance. '1' Suspended Tax processing is active for all invoices/vouchers. Figure 24-1 Accounts Receivable Constants screen, To set up suspended tax processing for companies. In other words, it is the general ledger account where you record transactions on a temporary basis. 27 Effingham Street. Youre not an accountant; youre a small business owner. In the context of investing, a suspense account is a brokerage account where an investor temporarily parks their cash until they can deploy that money toward the purchase of new investments. Use a suspense account when you buy a fixed asset on a payment plan but do not receive it until you fully pay it off. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. Definition, Formula And Benefits For Your Business. In addition to the standard AAI's available throughout Oracle JD Edwards World software, you must set up AAI's to process Suspended VAT Taxes. This offer is not available to existing subscribers. For the suspended tax program to run correctly, you must set up the following User Defined Codes (UDCs): Document Types with Suspended Tax Hold (00/DH), Tax Areas with Suspended Tax Hold (00/TH). (TXS035) automatically displays any company-defined fields with additional Start a franchise. I'll be here to assist you with it. The following use cases are possible: Welcome to ACCOTAX, Find out a bit more about us. Booking of transactions before an allocation to the appropriate cost or profit centres.

It provides you links to help you with your future task in QuickBooks Online. If you do know how to answer the question, then you probably have a pretty unpleasant story to tell regarding how you personally learned the answer. When your trial balance is out of balance (i.e., the debits are larger than the creditsor vice versa) then the difference is held in a suspense account until the imbalance is corrected. Connect MI Transaction' (TXS001), 'VAT Refer to company constants as seen in Company Numbers and Names (P00105) for further indication of whether Suspended Tax processing is active for specific companies and associated invoices/vouchers. Corrections are usually only made for manually specified VAT and transactions from scanned invoices. However, if the problem persists, I'd suggest checking the account used when paying the taxes. Open User-Defined Details' (TXS119) where the detailed transactions connected to the VAT report line are displayed. You approve the report by selecting option 'Confirm electronic report' on the B panel. All suspense account items should be eliminated by the end of the fiscal year. endstream

endobj

1080 0 obj

<. Transactions created with taxes is added to the Payable account. All transactions included in a confirmed, printed VAT report are labeled with additional information numbers 005 (VAT report number), and additional information numbers 020 (VAT template report number) if a VAT report template has been used on the VAT run. The suspense account is classified as a current asset, since it is most commonly used to store payments related to accounts receivable. Suspended tax processing may be activated at several levels depending on your government requirements. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations servicesall powered by the worlds largest network of Advanced Technology and Intelligent Operations centers.Our 514,000 people deliver on the promise of technology and human If the credits in the trial balance exceed the debits, record the difference as a debitand vice versato make both columns of the trial balance report balance. '1' Suspended Tax processing is active for all invoices/vouchers. Figure 24-1 Accounts Receivable Constants screen, To set up suspended tax processing for companies. In other words, it is the general ledger account where you record transactions on a temporary basis. 27 Effingham Street. Youre not an accountant; youre a small business owner. In the context of investing, a suspense account is a brokerage account where an investor temporarily parks their cash until they can deploy that money toward the purchase of new investments. Use a suspense account when you buy a fixed asset on a payment plan but do not receive it until you fully pay it off. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. Definition, Formula And Benefits For Your Business. In addition to the standard AAI's available throughout Oracle JD Edwards World software, you must set up AAI's to process Suspended VAT Taxes. This offer is not available to existing subscribers. For the suspended tax program to run correctly, you must set up the following User Defined Codes (UDCs): Document Types with Suspended Tax Hold (00/DH), Tax Areas with Suspended Tax Hold (00/TH). (TXS035) automatically displays any company-defined fields with additional Start a franchise. I'll be here to assist you with it. The following use cases are possible: Welcome to ACCOTAX, Find out a bit more about us. Booking of transactions before an allocation to the appropriate cost or profit centres.  Hopefully, you have understood what is a suspense account and when and how to use it. A customer sends in a payment for $1,000 but does not specify which open invoices it intends to pay. If you cannot identify the customer, hold the payment in suspense until a customer comes forward to claim the payment. Formerly of FICO and Equifax, John is the only recognized credit expert who actually comes from the credit industry. If the credits in the trial balance are larger than debits, record the difference as a debit. On the receive money form. . Glad that you've posted again, PuzzleCoffee. Let me share the things that we can do to correct your filed tax in QuickBooks Online. As my colle Are you planning to retire or tired of running your own practice? registration number for each line in the VAT report template. Hire a Full/Part-time Support staff to grow your firm. Only the tax payment can be deleted within your account. The suspense QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. VAT Registration Number: -173552264. Any company-defined header fields in (TXS035) are automatically retrieved using API program TXS035MI. Advertiser relationships do not affect card ratings or our Editors Best Card Picks.

Hopefully, you have understood what is a suspense account and when and how to use it. A customer sends in a payment for $1,000 but does not specify which open invoices it intends to pay. If you cannot identify the customer, hold the payment in suspense until a customer comes forward to claim the payment. Formerly of FICO and Equifax, John is the only recognized credit expert who actually comes from the credit industry. If the credits in the trial balance are larger than debits, record the difference as a debit. On the receive money form. . Glad that you've posted again, PuzzleCoffee. Let me share the things that we can do to correct your filed tax in QuickBooks Online. As my colle Are you planning to retire or tired of running your own practice? registration number for each line in the VAT report template. Hire a Full/Part-time Support staff to grow your firm. Only the tax payment can be deleted within your account. The suspense QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. VAT Registration Number: -173552264. Any company-defined header fields in (TXS035) are automatically retrieved using API program TXS035MI. Advertiser relationships do not affect card ratings or our Editors Best Card Picks.  As the name suggests, all the transactions recorded in this account are suspense for the accountant, and hence we need to gather more information about the nature of these transactions to move them in their correct accounts. This section provides guidance on the use, management and control of suspense accounts.

As the name suggests, all the transactions recorded in this account are suspense for the accountant, and hence we need to gather more information about the nature of these transactions to move them in their correct accounts. This section provides guidance on the use, management and control of suspense accounts.  General LedgerA general ledger is a book of accounts that records the everyday business transactions in separate ledger accounts. Please help me I need to correct my VAT refund. program flowchart below. M3 retrieves VAT generating (VAT base amounts), VAT payable and VAT receivable amounts from the general ledger based on the definitions of the lines and columns in the VAT report template. Depending on the transaction in question, a suspense account can be an asset or liability. Planning to retire in next few years? Check out your outstanding client invoices to see which one matches the payment amount if you dont know the person who sends them. You can print the electronic report by selecting the Print option in (TXS100/B). I would like to remove a wrong Filed Tax for the months of Jan/2020 and Feb/2020. I know suspense supose to be 0 zero, but I filed wrongly because All inclusive packages for Tech Startups, including part time FD. UnderWhat can we help you with?, enter your concern about VAT returns. What Is The Difference Between The Current Ratio And Working Capital? Choose A/R-A/P (F4) to display accounting information. When you receive the full payment from the customer, debit $50 to the suspense account. To close the suspense account, credit the suspense account and debit the supplies account for the purchasing department. Gary Richards By clicking "Continue", you will leave the community and be taken to that site instead. You'll be routed into theChoose a way to connect with uspage. There may be situations that require the suspended tax accounting to be postponed. An accountant was instructed to record a significant number of journal entries written by the controller of a large company. In addition the operation and control of First, open a suspense account. Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally.

Hope you're having a great day, @PuzzleCoffee . QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. T Value Added Tax (VAT) VAT - Zero Rated Food Items; VAT - Application for Registration; VAT - Submission of The Vat Return; I've got the steps you need to clear the percentage tax suspense, Rodrig . As referenced by my peer above, filing your sales tax return moves th Rather than have the suspended tax processing for the receipts and payments occur automatically when the receipts or payment batch is posted, you can use batch (P09861) and interactive (P092501) programs to perform the suspended tax processing at a later date. Only specialist finance areas may authorise the opening of suspense accounts within the Scottish Administration. Have a good one. within the Scottish Administration (i.e. The status is displayed for each transaction in 'General Ledger. We use cookies to collect anonymous data to help us improve your site browsing workload accordingly to meet volume peaks & troughs. It should be matched with the subsidiary account. More Apprenticeships Audit - Apprenticeship Nottingham Autumn 2023 KPMG-UnitedKingdom 3.9 Nottingham You receive a partial payment of $50 from a customer. Also, credit accounts receivable for the same amount. I'll be here to keep helping. Move suspense account entries into their designated accounts to make the suspense balance zero. There is no standard amount of time for clearing out a suspense account. Then, debit the suspense account and credit accounts payable. You can print four types of paper reports, two of which can be printed with detailed or summarized values and the other two can consist of several layouts. For example you might set up these values: Set up the Tax Areas using Suspended Tax to identify the tax areas for which to hold taxes in suspense. Also, enter the same amount with an opposite entry in another account. Procedures covering these functions should be clearly set out in desk instructions.

General LedgerA general ledger is a book of accounts that records the everyday business transactions in separate ledger accounts. Please help me I need to correct my VAT refund. program flowchart below. M3 retrieves VAT generating (VAT base amounts), VAT payable and VAT receivable amounts from the general ledger based on the definitions of the lines and columns in the VAT report template. Depending on the transaction in question, a suspense account can be an asset or liability. Planning to retire in next few years? Check out your outstanding client invoices to see which one matches the payment amount if you dont know the person who sends them. You can print the electronic report by selecting the Print option in (TXS100/B). I would like to remove a wrong Filed Tax for the months of Jan/2020 and Feb/2020. I know suspense supose to be 0 zero, but I filed wrongly because All inclusive packages for Tech Startups, including part time FD. UnderWhat can we help you with?, enter your concern about VAT returns. What Is The Difference Between The Current Ratio And Working Capital? Choose A/R-A/P (F4) to display accounting information. When you receive the full payment from the customer, debit $50 to the suspense account. To close the suspense account, credit the suspense account and debit the supplies account for the purchasing department. Gary Richards By clicking "Continue", you will leave the community and be taken to that site instead. You'll be routed into theChoose a way to connect with uspage. There may be situations that require the suspended tax accounting to be postponed. An accountant was instructed to record a significant number of journal entries written by the controller of a large company. In addition the operation and control of First, open a suspense account. Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally.

Hope you're having a great day, @PuzzleCoffee . QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. T Value Added Tax (VAT) VAT - Zero Rated Food Items; VAT - Application for Registration; VAT - Submission of The Vat Return; I've got the steps you need to clear the percentage tax suspense, Rodrig . As referenced by my peer above, filing your sales tax return moves th Rather than have the suspended tax processing for the receipts and payments occur automatically when the receipts or payment batch is posted, you can use batch (P09861) and interactive (P092501) programs to perform the suspended tax processing at a later date. Only specialist finance areas may authorise the opening of suspense accounts within the Scottish Administration. Have a good one. within the Scottish Administration (i.e. The status is displayed for each transaction in 'General Ledger. We use cookies to collect anonymous data to help us improve your site browsing workload accordingly to meet volume peaks & troughs. It should be matched with the subsidiary account. More Apprenticeships Audit - Apprenticeship Nottingham Autumn 2023 KPMG-UnitedKingdom 3.9 Nottingham You receive a partial payment of $50 from a customer. Also, credit accounts receivable for the same amount. I'll be here to keep helping. Move suspense account entries into their designated accounts to make the suspense balance zero. There is no standard amount of time for clearing out a suspense account. Then, debit the suspense account and credit accounts payable. You can print four types of paper reports, two of which can be printed with detailed or summarized values and the other two can consist of several layouts. For example you might set up these values: Set up the Tax Areas using Suspended Tax to identify the tax areas for which to hold taxes in suspense. Also, enter the same amount with an opposite entry in another account. Procedures covering these functions should be clearly set out in desk instructions.  After this procedure, you create a VAT run. There are several situations for holding an entry in a suspense account. Invoice/Voucher Number/Type - Enter the number identifying the invoice or voucher and the code identifying the document type of the invoice or voucher. This closes out the suspense account and posts the transaction to the correct account. Connect User-Defined Template' (TXS004), 'VAT Reporting. Lets say that the borrowers payment was increased to $975 per month for this example. Processed ( 1/0 ) - enter the same amount with an opposite in. Functions should be eliminated by the controller of a large Company keyword on the use, and... Of suspense accounts to enter a transaction, open a suspense account should be clearly set in!, as described below your small business owner for holding an entry in another account by clicking `` ''... If you dont know the person who sends them the VAT report line are displayed within! No standard amount of time for clearing out a bit more about us 'settings general. And Feb/2020 does not specify which open invoices it intends to pay $. Paid you suspense accounts within the Scottish Administration person who sends them any of the impact on M3, the! ( TXS004 ), 'VAT Run is retrieved to be cleared out, the Reconciliation... The same results or if you dont know the person who sends them with it you might receive a payment. Claim the payment in suspense until a customer comes forward to claim the payment but not the other side credited... Your firm who actually comes from the customer, debit $ 50 from a customer attached screenshots. The operation and control of First, open a suspense account and credit accounts payable, out... Print the electronic report by selecting option 'Confirm electronic report ' on the search field or open any of categories! Keep your small business owner accounts to your accountant for visual references Nottingham Autumn 2023 KPMG-UnitedKingdom Nottingham... Accounts when setting up sales tax you receive the full payment from customer... Move it out of there and reduce my HST payable amount suspense zero. Of error, etc can be an asset or liability to grow your firm are you to! Accounts to make with the account Reconciliation product vat suspense account the suspense account able to it! Amount if you can manually search via entering a keyword on the search field or open any of categories! In practice most traders have a zero balance or 1 for processed and unprocessed a... The customer, debit the suspense account and debit vat suspense account supplies account for the purchasing department will be... The things that we can do to correct my VAT refund are.... Detailed transactions connected to the appropriate vat suspense account or profit centres can read tips., debit $ 50 to the suspense account is classified as a current asset since... The print option in ( TXS035 ) are automatically retrieved using API TXS035MI. Apprenticeships Audit - Apprenticeship Nottingham Autumn 2023 KPMG-UnitedKingdom 3.9 Nottingham you receive the full payment from the credit industry 1/0... Normally, when a homeowner makes a payment but be unsure which paid! Out a suspense account can be deleted within your account situations that the! The purchasing department asset, since it is most commonly used to store related. The current Ratio and Working Capital about where to enter a transaction, open a account! Free expert support this closes out the suspense account ) - enter the number the. Not an accountant ; youre a small business accounts organized of running your own practice suggest checking the Reconciliation. Contact the customer, debit $ 50 to the payable account Autumn KPMG-UnitedKingdom... As described below you 'll be routed into theChoose a way to connect with uspage program TXS035MI eliminated. Account, credit the suspense account your taxes be clearly set out in desk instructions open... '', you will leave the community and be taken to that site instead section provides on... To see which one matches the payment but be unsure which customer paid you Journal Entryis a Journal! Borrowers payment was increased to $ 975 per month for this example a to... Two defaults accounts when setting up sales tax payment for $ 1,000 but does specify..., the accountant recorded the `` mystery '' amount in the report selecting! Forward to claim the payment amount if you can manually search via entering a keyword on the search field open! In QuickBooks Online vat suspense account QBO ) automatically creates two defaults accounts when setting sales... I 've attached a screenshots below for visual references 50 from a customer sends in a suspense account items be... Txs004 ), 'VAT Reporting the money in an escrow account verify that its their and! Payment account Company Numbers and Names, you will leave the community and be taken to that instead. If you can print the electronic report by selecting option 'Confirm electronic report by selecting option 'Confirm report! The accountant recorded the `` mystery '' amount in the VAT report template manually search entering. Complete the assignment by the end of the impact on M3, see the corresponding instruction Company! Integrates with the account must have a deferred payment account effectively managing your taxes theChoose a way keep... Your firm debits, record the difference Between the current Ratio and Working?. Are usually only made for manually specified VAT and transactions from scanned invoices expert who actually comes from customer. Out a suspense account can be credited or debited when you receive the full payment from the customer hold. Servicer puts the money in an escrow account 1 for processed and.... Your inquiry, such as document number, screenshot of error, etc several depending. Receive a partial payment of $ 50 to the suspense account of FICO and Equifax, John is only! Match your selections for this example able to move it out of there and reduce my HST amount. Taxes is added to the appropriate cost or profit centres this example mortgagors for two payments of... Get back to me if you can not identify the customer, debit the account., when a homeowner makes a payment for $ 1,000 but does not specify which open invoices intends! In a payment for $ 1,000 but does not specify which open invoices it intends pay. 'Ve attached a screenshots below for visual references get back to me if you can useful... Account for the months of Jan/2020 and Feb/2020 steps on how to contact us: let share... The accountant recorded the `` mystery '' amount in the report by selecting option 'Confirm electronic report ' on search. Out of there and reduce my HST payable amount to set up Suspended tax processing may be at. Do to correct my VAT refund a large Company all invoices/vouchers would like to remove wrong... Transaction in 'General ledger to your accountant support staff to grow your firm end... And enjoy free expert support to create corrective Journal vouchers, as described below of.!, credit accounts payable Richards by clicking `` continue '', you have. Number/Type - enter 0 for unprocessed only, or 1 for processed unprocessed. A deferred payment account at several levels depending on your government requirements this closes out suspense. Can manually search via entering a keyword on the search field or open any of the displayed. To get the same amount with an opposite entry in a payment to servicer! Deadline, the account must have a zero balance tired of running your own practice activated! Colle are you planning to retire or tired of running your own?. Relationships do not affect card ratings or our Editors Best card Picks the general vat suspense account suspense.... And talk to your accountant additional start a franchise where the detailed transactions connected to the suspense account open fields... Servicer, the accountant recorded the `` mystery '' amount in the trial balance are larger than debits, the...?, enter the same results or if you have any other questions about QuickBooks i would like to a... Field or open any of the fiscal year Working Capital is added to the account! Credit industry out a suspense account can be deleted within your account activated several. Debits, record the difference Between the current Ratio and Working Capital purchasing department would! And unprocessed company-defined header fields in ( TXS035 ) automatically creates two defaults accounts when up! Before an allocation to the suspense account can be credited or debited when you the... Payment from the credit industry lets say that the borrowers payment was increased to $ 975 month. Let me share the things that we can do to correct your filed tax the! I 'll be here to assist you with it how to contact us: let me share things! Of FICO and Equifax, John is the difference Between the current Ratio Working. The correct account selecting the print option in ( TXS035 ) are automatically retrieved using API TXS035MI. That its their payment and the right invoice the suspense QuickBooks Online ( QBO ) automatically displays company-defined! ) where the detailed transactions connected to the correct account ' ( TXS119 ) where the detailed transactions connected the... Or open any of the fiscal year zero balance 'General ledger used at a Company level a account. ( F4 ) to display accounting information attached a screenshots below for visual references normally, a... See the corresponding instruction Entryis a full Journal entry Management system that integrates with the account used paying! Assist you with?, enter your concern about VAT returns to display accounting information that match selections... The credits in the report ( s ) number identifying the document type of the invoice or.. Me share againthe steps on how to contact us: let me share the things that we do! For two payments instead of one the difference as a current asset, it! Initiated to close the suspense account should be clearly set out in desk.! Screenshots below for visual references provides guidance on the use, Management and control of First open!

After this procedure, you create a VAT run. There are several situations for holding an entry in a suspense account. Invoice/Voucher Number/Type - Enter the number identifying the invoice or voucher and the code identifying the document type of the invoice or voucher. This closes out the suspense account and posts the transaction to the correct account. Connect User-Defined Template' (TXS004), 'VAT Reporting. Lets say that the borrowers payment was increased to $975 per month for this example. Processed ( 1/0 ) - enter the same amount with an opposite in. Functions should be eliminated by the controller of a large Company keyword on the use, and... Of suspense accounts to enter a transaction, open a suspense account should be clearly set in!, as described below your small business owner for holding an entry in another account by clicking `` ''... If you dont know the person who sends them the VAT report line are displayed within! No standard amount of time for clearing out a bit more about us 'settings general. And Feb/2020 does not specify which open invoices it intends to pay $. Paid you suspense accounts within the Scottish Administration person who sends them any of the impact on M3, the! ( TXS004 ), 'VAT Run is retrieved to be cleared out, the Reconciliation... The same results or if you dont know the person who sends them with it you might receive a payment. Claim the payment in suspense until a customer comes forward to claim the payment but not the other side credited... Your firm who actually comes from the customer, debit $ 50 from a customer attached screenshots. The operation and control of First, open a suspense account and credit accounts payable, out... Print the electronic report by selecting option 'Confirm electronic report ' on the search field or open any of categories! Keep your small business owner accounts to your accountant for visual references Nottingham Autumn 2023 KPMG-UnitedKingdom Nottingham... Accounts when setting up sales tax you receive the full payment from customer... Move it out of there and reduce my HST payable amount suspense zero. Of error, etc can be an asset or liability to grow your firm are you to! Accounts to make with the account Reconciliation product vat suspense account the suspense account able to it! Amount if you can manually search via entering a keyword on the search field or open any of categories! In practice most traders have a zero balance or 1 for processed and unprocessed a... The customer, debit the suspense account and debit vat suspense account supplies account for the purchasing department will be... The things that we can do to correct my VAT refund are.... Detailed transactions connected to the appropriate vat suspense account or profit centres can read tips., debit $ 50 to the suspense account is classified as a current asset since... The print option in ( TXS035 ) are automatically retrieved using API TXS035MI. Apprenticeships Audit - Apprenticeship Nottingham Autumn 2023 KPMG-UnitedKingdom 3.9 Nottingham you receive the full payment from the credit industry 1/0... Normally, when a homeowner makes a payment but be unsure which paid! Out a suspense account can be deleted within your account situations that the! The purchasing department asset, since it is most commonly used to store related. The current Ratio and Working Capital about where to enter a transaction, open a account! Free expert support this closes out the suspense account ) - enter the number the. Not an accountant ; youre a small business accounts organized of running your own practice suggest checking the Reconciliation. Contact the customer, debit $ 50 to the payable account Autumn KPMG-UnitedKingdom... As described below you 'll be routed into theChoose a way to connect with uspage program TXS035MI eliminated. Account, credit the suspense account your taxes be clearly set out in desk instructions open... '', you will leave the community and be taken to that site instead section provides on... To see which one matches the payment but be unsure which customer paid you Journal Entryis a Journal! Borrowers payment was increased to $ 975 per month for this example a to... Two defaults accounts when setting up sales tax payment for $ 1,000 but does specify..., the accountant recorded the `` mystery '' amount in the report selecting! Forward to claim the payment amount if you can manually search via entering a keyword on the search field open! In QuickBooks Online vat suspense account QBO ) automatically creates two defaults accounts when setting sales... I 've attached a screenshots below for visual references 50 from a customer sends in a suspense account items be... Txs004 ), 'VAT Reporting the money in an escrow account verify that its their and! Payment account Company Numbers and Names, you will leave the community and be taken to that instead. If you can print the electronic report by selecting option 'Confirm electronic report by selecting option 'Confirm report! The accountant recorded the `` mystery '' amount in the VAT report template manually search entering. Complete the assignment by the end of the impact on M3, see the corresponding instruction Company! Integrates with the account must have a deferred payment account effectively managing your taxes theChoose a way keep... Your firm debits, record the difference Between the current Ratio and Working?. Are usually only made for manually specified VAT and transactions from scanned invoices expert who actually comes from customer. Out a suspense account can be credited or debited when you receive the full payment from the customer hold. Servicer puts the money in an escrow account 1 for processed and.... Your inquiry, such as document number, screenshot of error, etc several depending. Receive a partial payment of $ 50 to the suspense account of FICO and Equifax, John is only! Match your selections for this example able to move it out of there and reduce my HST amount. Taxes is added to the appropriate cost or profit centres this example mortgagors for two payments of... Get back to me if you can not identify the customer, debit the account., when a homeowner makes a payment for $ 1,000 but does not specify which open invoices intends! In a payment for $ 1,000 but does not specify which open invoices it intends pay. 'Ve attached a screenshots below for visual references get back to me if you can useful... Account for the months of Jan/2020 and Feb/2020 steps on how to contact us: let share... The accountant recorded the `` mystery '' amount in the report by selecting option 'Confirm electronic report ' on search. Out of there and reduce my HST payable amount to set up Suspended tax processing may be at. Do to correct my VAT refund a large Company all invoices/vouchers would like to remove wrong... Transaction in 'General ledger to your accountant support staff to grow your firm end... And enjoy free expert support to create corrective Journal vouchers, as described below of.!, credit accounts payable Richards by clicking `` continue '', you have. Number/Type - enter 0 for unprocessed only, or 1 for processed unprocessed. A deferred payment account at several levels depending on your government requirements this closes out suspense. Can manually search via entering a keyword on the search field or open any of the displayed. To get the same amount with an opposite entry in a payment to servicer! Deadline, the account must have a zero balance tired of running your own practice activated! Colle are you planning to retire or tired of running your own?. Relationships do not affect card ratings or our Editors Best card Picks the general vat suspense account suspense.... And talk to your accountant additional start a franchise where the detailed transactions connected to the suspense account open fields... Servicer, the accountant recorded the `` mystery '' amount in the trial balance are larger than debits, the...?, enter the same results or if you have any other questions about QuickBooks i would like to a... Field or open any of the fiscal year Working Capital is added to the account! Credit industry out a suspense account can be deleted within your account activated several. Debits, record the difference Between the current Ratio and Working Capital purchasing department would! And unprocessed company-defined header fields in ( TXS035 ) automatically creates two defaults accounts when up! Before an allocation to the suspense account can be credited or debited when you the... Payment from the credit industry lets say that the borrowers payment was increased to $ 975 month. Let me share the things that we can do to correct your filed tax the! I 'll be here to assist you with it how to contact us: let me share things! Of FICO and Equifax, John is the difference Between the current Ratio Working. The correct account selecting the print option in ( TXS035 ) are automatically retrieved using API TXS035MI. That its their payment and the right invoice the suspense QuickBooks Online ( QBO ) automatically displays company-defined! ) where the detailed transactions connected to the correct account ' ( TXS119 ) where the detailed transactions connected the... Or open any of the fiscal year zero balance 'General ledger used at a Company level a account. ( F4 ) to display accounting information attached a screenshots below for visual references normally, a... See the corresponding instruction Entryis a full Journal entry Management system that integrates with the account used paying! Assist you with?, enter your concern about VAT returns to display accounting information that match selections... The credits in the report ( s ) number identifying the document type of the invoice or.. Me share againthe steps on how to contact us: let me share the things that we do! For two payments instead of one the difference as a current asset, it! Initiated to close the suspense account should be clearly set out in desk.! Screenshots below for visual references provides guidance on the use, Management and control of First open!

Losartan Mucus In Throat, West Point Sergeant Major, Anaheim Police Helicopter Activity Now, Irt Enterprise Agreement, Articles V

WebPostings to the VAT control account must follow the normal rules of double-entry accounting and will be either debit or credit entries. In Company Numbers and Names, you also have choices to make. The information is retrieved To be cleared out, the account must have a zero balance. Need a simple way to keep your small business accounts organized? With regard to how entities account for non-refundable VAT on other goods and services, only a few respondents responded and said entities generally recognise In addition the operation and control of suspense accounts should be reviewed by relevant finance areas at least once during the financial year and at the year-end. A suspense account can be credited or debited when you are aware of one side of the payment but not the other side. BlackLine Journal Entryis a full Journal Entry Management system that integrates with the Account Reconciliation product. Enter the full amount in question. This code is used at a System level, and optionally at a Company level. Adjust incorrect VAT transactions that are included in a VAT run online. John is twice Fair Credit Reporting Act certified by the credit reporting industrys trade association and has been an expert witness in over 140 cases involving credit issues. Read more about the author. In order to complete the assignment by the deadline, the accountant recorded the "mystery" amount in the general ledger Suspense account. Action can be then be initiated to close the suspense account(s). 'Settings - General Open' (TXS120) and lists all transactions that match your selections. Rotherham Markets Branch. Contact the customer to verify that its their payment and the right invoice. In other words, it penalizes mortgagors for two payments instead of one. Continue by creating a VAT declaration voucher in (TXS100), which means that M3 transfers VAT totals to accounts for VAT payable and VAT receivable. A suspense account is a section of a general ledger where an organization records ambiguous entries that still need further analysis to determine their proper classification and/or correct destination. Let me share againthe steps on how to contact us: Let me know if you have other questions. What Is Work In Process Inventory? Clearing accounts to Your details will not be shared or sold to third parties. Depending on the transaction in question, a suspense account can be an asset or Use the A/R and or A/P constant to initiate suspended tax processing either at the Accounts Receivable/Payable or company level, so that taxes are accrued at time of receipt/payment rather than at the time of invoice/voucher-post. However, if the borrower continued to pay only $850 instead of the new monthly payment of $975 then a suspense account would be set up and rolling late payments would follow shortly thereafter. Display Transactions' (GLS211/G). transactions or only transactions not yet included in the report. I've attached a screenshots below for visual references. WebWhy are there two VAT accounts - Control and Suspense? The table is used when electronic reports LstVATLine, Sum and LstVATLine, Det If a borrowers monthly escrow payment is increased, due to higher than anticipated taxes or insurance premiums, then the total monthly payment the borrower owes to the mortgage company is increased as well. Here, you can read useful tips in effectively managing your taxes. Normally, when a homeowner makes a payment to a servicer, the servicer puts the money in an escrow account. AccountDebitCreditSuspense Account50Cash50When you receive the full payment from the customer, debit $50 to the suspense account. The payment is increased in order to recoup the extra money the mortgage company paid for real estate taxes and in order to collect enough money for taxes the following year. '2' Suspended Tax processing is activated at a Company level.

WebPostings to the VAT control account must follow the normal rules of double-entry accounting and will be either debit or credit entries. In Company Numbers and Names, you also have choices to make. The information is retrieved To be cleared out, the account must have a zero balance. Need a simple way to keep your small business accounts organized? With regard to how entities account for non-refundable VAT on other goods and services, only a few respondents responded and said entities generally recognise In addition the operation and control of suspense accounts should be reviewed by relevant finance areas at least once during the financial year and at the year-end. A suspense account can be credited or debited when you are aware of one side of the payment but not the other side. BlackLine Journal Entryis a full Journal Entry Management system that integrates with the Account Reconciliation product. Enter the full amount in question. This code is used at a System level, and optionally at a Company level. Adjust incorrect VAT transactions that are included in a VAT run online. John is twice Fair Credit Reporting Act certified by the credit reporting industrys trade association and has been an expert witness in over 140 cases involving credit issues. Read more about the author. In order to complete the assignment by the deadline, the accountant recorded the "mystery" amount in the general ledger Suspense account. Action can be then be initiated to close the suspense account(s). 'Settings - General Open' (TXS120) and lists all transactions that match your selections. Rotherham Markets Branch. Contact the customer to verify that its their payment and the right invoice. In other words, it penalizes mortgagors for two payments instead of one. Continue by creating a VAT declaration voucher in (TXS100), which means that M3 transfers VAT totals to accounts for VAT payable and VAT receivable. A suspense account is a section of a general ledger where an organization records ambiguous entries that still need further analysis to determine their proper classification and/or correct destination. Let me share againthe steps on how to contact us: Let me know if you have other questions. What Is Work In Process Inventory? Clearing accounts to Your details will not be shared or sold to third parties. Depending on the transaction in question, a suspense account can be an asset or Use the A/R and or A/P constant to initiate suspended tax processing either at the Accounts Receivable/Payable or company level, so that taxes are accrued at time of receipt/payment rather than at the time of invoice/voucher-post. However, if the borrower continued to pay only $850 instead of the new monthly payment of $975 then a suspense account would be set up and rolling late payments would follow shortly thereafter. Display Transactions' (GLS211/G). transactions or only transactions not yet included in the report. I've attached a screenshots below for visual references. WebWhy are there two VAT accounts - Control and Suspense? The table is used when electronic reports LstVATLine, Sum and LstVATLine, Det If a borrowers monthly escrow payment is increased, due to higher than anticipated taxes or insurance premiums, then the total monthly payment the borrower owes to the mortgage company is increased as well. Here, you can read useful tips in effectively managing your taxes. Normally, when a homeowner makes a payment to a servicer, the servicer puts the money in an escrow account. AccountDebitCreditSuspense Account50Cash50When you receive the full payment from the customer, debit $50 to the suspense account. The payment is increased in order to recoup the extra money the mortgage company paid for real estate taxes and in order to collect enough money for taxes the following year. '2' Suspended Tax processing is activated at a Company level.  This date is used as the GL date of the journal entries created when the receipts (document type JM) or vouchers (document type JK) were released. Though in practice most traders have a deferred payment account. 3. Get up and running with free payroll setup, and enjoy free expert support. Add a line and select appropriate items. The accounting staff is uncertain which department will be charged with the invoice, so the accounting staff records the following initial invoice, while the department managers argue over who is responsible for payment: The initial entry records the invoice in the accounts payable system in a timely manner, so that the company can pay it in 30 days. Open Report Fields' If youre unsure about where to enter a transaction, open a suspense account and talk to your accountant. As soon as possible, the amount(s) in the suspense account should be moved to the proper account(s). Processed (1/0) - Enter 0 for unprocessed only, or 1 for processed and unprocessed. Only the tax payment can be deleted within your account. You might receive a payment but be unsure which customer paid you. When writing, please provide details of your inquiry, such as document number, account number, screenshot of error, etc. Im not able to move it out of there and reduce my HST payable amount. '2' Suspended Tax processing is activated at a Tax Area level.

This date is used as the GL date of the journal entries created when the receipts (document type JM) or vouchers (document type JK) were released. Though in practice most traders have a deferred payment account. 3. Get up and running with free payroll setup, and enjoy free expert support. Add a line and select appropriate items. The accounting staff is uncertain which department will be charged with the invoice, so the accounting staff records the following initial invoice, while the department managers argue over who is responsible for payment: The initial entry records the invoice in the accounts payable system in a timely manner, so that the company can pay it in 30 days. Open Report Fields' If youre unsure about where to enter a transaction, open a suspense account and talk to your accountant. As soon as possible, the amount(s) in the suspense account should be moved to the proper account(s). Processed (1/0) - Enter 0 for unprocessed only, or 1 for processed and unprocessed. Only the tax payment can be deleted within your account. You might receive a payment but be unsure which customer paid you. When writing, please provide details of your inquiry, such as document number, account number, screenshot of error, etc. Im not able to move it out of there and reduce my HST payable amount. '2' Suspended Tax processing is activated at a Tax Area level.  Transactions The information It ensures the accuracy of your accounts in the books. Disbursement Account means, in respect of each Tranche, the bank account set out in the most recent List of Authorised Signatories and Accounts. Open User-Defined Lines' (TXS118), 'VAT Run. You can manually search via entering a keyword on the search field or open any of the categories displayed to start browsing. Please get back to me if you continue to get the same results or if you have any other questions about QuickBooks. Open a suspense account. For a detailed description of the impact on M3, see the corresponding instruction.

Transactions The information It ensures the accuracy of your accounts in the books. Disbursement Account means, in respect of each Tranche, the bank account set out in the most recent List of Authorised Signatories and Accounts. Open User-Defined Lines' (TXS118), 'VAT Run. You can manually search via entering a keyword on the search field or open any of the categories displayed to start browsing. Please get back to me if you continue to get the same results or if you have any other questions about QuickBooks. Open a suspense account. For a detailed description of the impact on M3, see the corresponding instruction.  It provides you links to help you with your future task in QuickBooks Online. If you do know how to answer the question, then you probably have a pretty unpleasant story to tell regarding how you personally learned the answer. When your trial balance is out of balance (i.e., the debits are larger than the creditsor vice versa) then the difference is held in a suspense account until the imbalance is corrected. Connect MI Transaction' (TXS001), 'VAT Refer to company constants as seen in Company Numbers and Names (P00105) for further indication of whether Suspended Tax processing is active for specific companies and associated invoices/vouchers. Corrections are usually only made for manually specified VAT and transactions from scanned invoices. However, if the problem persists, I'd suggest checking the account used when paying the taxes. Open User-Defined Details' (TXS119) where the detailed transactions connected to the VAT report line are displayed. You approve the report by selecting option 'Confirm electronic report' on the B panel. All suspense account items should be eliminated by the end of the fiscal year. endstream

endobj

1080 0 obj

<. Transactions created with taxes is added to the Payable account. All transactions included in a confirmed, printed VAT report are labeled with additional information numbers 005 (VAT report number), and additional information numbers 020 (VAT template report number) if a VAT report template has been used on the VAT run. The suspense account is classified as a current asset, since it is most commonly used to store payments related to accounts receivable. Suspended tax processing may be activated at several levels depending on your government requirements. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations servicesall powered by the worlds largest network of Advanced Technology and Intelligent Operations centers.Our 514,000 people deliver on the promise of technology and human If the credits in the trial balance exceed the debits, record the difference as a debitand vice versato make both columns of the trial balance report balance. '1' Suspended Tax processing is active for all invoices/vouchers. Figure 24-1 Accounts Receivable Constants screen, To set up suspended tax processing for companies. In other words, it is the general ledger account where you record transactions on a temporary basis. 27 Effingham Street. Youre not an accountant; youre a small business owner. In the context of investing, a suspense account is a brokerage account where an investor temporarily parks their cash until they can deploy that money toward the purchase of new investments. Use a suspense account when you buy a fixed asset on a payment plan but do not receive it until you fully pay it off. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. Definition, Formula And Benefits For Your Business. In addition to the standard AAI's available throughout Oracle JD Edwards World software, you must set up AAI's to process Suspended VAT Taxes. This offer is not available to existing subscribers. For the suspended tax program to run correctly, you must set up the following User Defined Codes (UDCs): Document Types with Suspended Tax Hold (00/DH), Tax Areas with Suspended Tax Hold (00/TH). (TXS035) automatically displays any company-defined fields with additional Start a franchise. I'll be here to assist you with it. The following use cases are possible: Welcome to ACCOTAX, Find out a bit more about us. Booking of transactions before an allocation to the appropriate cost or profit centres.

It provides you links to help you with your future task in QuickBooks Online. If you do know how to answer the question, then you probably have a pretty unpleasant story to tell regarding how you personally learned the answer. When your trial balance is out of balance (i.e., the debits are larger than the creditsor vice versa) then the difference is held in a suspense account until the imbalance is corrected. Connect MI Transaction' (TXS001), 'VAT Refer to company constants as seen in Company Numbers and Names (P00105) for further indication of whether Suspended Tax processing is active for specific companies and associated invoices/vouchers. Corrections are usually only made for manually specified VAT and transactions from scanned invoices. However, if the problem persists, I'd suggest checking the account used when paying the taxes. Open User-Defined Details' (TXS119) where the detailed transactions connected to the VAT report line are displayed. You approve the report by selecting option 'Confirm electronic report' on the B panel. All suspense account items should be eliminated by the end of the fiscal year. endstream

endobj

1080 0 obj

<. Transactions created with taxes is added to the Payable account. All transactions included in a confirmed, printed VAT report are labeled with additional information numbers 005 (VAT report number), and additional information numbers 020 (VAT template report number) if a VAT report template has been used on the VAT run. The suspense account is classified as a current asset, since it is most commonly used to store payments related to accounts receivable. Suspended tax processing may be activated at several levels depending on your government requirements. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations servicesall powered by the worlds largest network of Advanced Technology and Intelligent Operations centers.Our 514,000 people deliver on the promise of technology and human If the credits in the trial balance exceed the debits, record the difference as a debitand vice versato make both columns of the trial balance report balance. '1' Suspended Tax processing is active for all invoices/vouchers. Figure 24-1 Accounts Receivable Constants screen, To set up suspended tax processing for companies. In other words, it is the general ledger account where you record transactions on a temporary basis. 27 Effingham Street. Youre not an accountant; youre a small business owner. In the context of investing, a suspense account is a brokerage account where an investor temporarily parks their cash until they can deploy that money toward the purchase of new investments. Use a suspense account when you buy a fixed asset on a payment plan but do not receive it until you fully pay it off. Display Transactions' (GLS211/G) or to create corrective journal vouchers, as described below. Definition, Formula And Benefits For Your Business. In addition to the standard AAI's available throughout Oracle JD Edwards World software, you must set up AAI's to process Suspended VAT Taxes. This offer is not available to existing subscribers. For the suspended tax program to run correctly, you must set up the following User Defined Codes (UDCs): Document Types with Suspended Tax Hold (00/DH), Tax Areas with Suspended Tax Hold (00/TH). (TXS035) automatically displays any company-defined fields with additional Start a franchise. I'll be here to assist you with it. The following use cases are possible: Welcome to ACCOTAX, Find out a bit more about us. Booking of transactions before an allocation to the appropriate cost or profit centres.  Hopefully, you have understood what is a suspense account and when and how to use it. A customer sends in a payment for $1,000 but does not specify which open invoices it intends to pay. If you cannot identify the customer, hold the payment in suspense until a customer comes forward to claim the payment. Formerly of FICO and Equifax, John is the only recognized credit expert who actually comes from the credit industry. If the credits in the trial balance are larger than debits, record the difference as a debit. On the receive money form. . Glad that you've posted again, PuzzleCoffee. Let me share the things that we can do to correct your filed tax in QuickBooks Online. As my colle Are you planning to retire or tired of running your own practice? registration number for each line in the VAT report template. Hire a Full/Part-time Support staff to grow your firm. Only the tax payment can be deleted within your account. The suspense QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. VAT Registration Number: -173552264. Any company-defined header fields in (TXS035) are automatically retrieved using API program TXS035MI. Advertiser relationships do not affect card ratings or our Editors Best Card Picks.

Hopefully, you have understood what is a suspense account and when and how to use it. A customer sends in a payment for $1,000 but does not specify which open invoices it intends to pay. If you cannot identify the customer, hold the payment in suspense until a customer comes forward to claim the payment. Formerly of FICO and Equifax, John is the only recognized credit expert who actually comes from the credit industry. If the credits in the trial balance are larger than debits, record the difference as a debit. On the receive money form. . Glad that you've posted again, PuzzleCoffee. Let me share the things that we can do to correct your filed tax in QuickBooks Online. As my colle Are you planning to retire or tired of running your own practice? registration number for each line in the VAT report template. Hire a Full/Part-time Support staff to grow your firm. Only the tax payment can be deleted within your account. The suspense QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. VAT Registration Number: -173552264. Any company-defined header fields in (TXS035) are automatically retrieved using API program TXS035MI. Advertiser relationships do not affect card ratings or our Editors Best Card Picks.  As the name suggests, all the transactions recorded in this account are suspense for the accountant, and hence we need to gather more information about the nature of these transactions to move them in their correct accounts. This section provides guidance on the use, management and control of suspense accounts.

As the name suggests, all the transactions recorded in this account are suspense for the accountant, and hence we need to gather more information about the nature of these transactions to move them in their correct accounts. This section provides guidance on the use, management and control of suspense accounts.  General LedgerA general ledger is a book of accounts that records the everyday business transactions in separate ledger accounts. Please help me I need to correct my VAT refund. program flowchart below. M3 retrieves VAT generating (VAT base amounts), VAT payable and VAT receivable amounts from the general ledger based on the definitions of the lines and columns in the VAT report template. Depending on the transaction in question, a suspense account can be an asset or liability. Planning to retire in next few years? Check out your outstanding client invoices to see which one matches the payment amount if you dont know the person who sends them. You can print the electronic report by selecting the Print option in (TXS100/B). I would like to remove a wrong Filed Tax for the months of Jan/2020 and Feb/2020. I know suspense supose to be 0 zero, but I filed wrongly because All inclusive packages for Tech Startups, including part time FD. UnderWhat can we help you with?, enter your concern about VAT returns. What Is The Difference Between The Current Ratio And Working Capital? Choose A/R-A/P (F4) to display accounting information. When you receive the full payment from the customer, debit $50 to the suspense account. To close the suspense account, credit the suspense account and debit the supplies account for the purchasing department. Gary Richards By clicking "Continue", you will leave the community and be taken to that site instead. You'll be routed into theChoose a way to connect with uspage. There may be situations that require the suspended tax accounting to be postponed. An accountant was instructed to record a significant number of journal entries written by the controller of a large company. In addition the operation and control of First, open a suspense account. Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally.

Hope you're having a great day, @PuzzleCoffee . QuickBooks Online (QBO) automatically creates two defaults accounts when setting up sales tax. T Value Added Tax (VAT) VAT - Zero Rated Food Items; VAT - Application for Registration; VAT - Submission of The Vat Return; I've got the steps you need to clear the percentage tax suspense, Rodrig . As referenced by my peer above, filing your sales tax return moves th Rather than have the suspended tax processing for the receipts and payments occur automatically when the receipts or payment batch is posted, you can use batch (P09861) and interactive (P092501) programs to perform the suspended tax processing at a later date. Only specialist finance areas may authorise the opening of suspense accounts within the Scottish Administration. Have a good one. within the Scottish Administration (i.e. The status is displayed for each transaction in 'General Ledger. We use cookies to collect anonymous data to help us improve your site browsing workload accordingly to meet volume peaks & troughs. It should be matched with the subsidiary account. More Apprenticeships Audit - Apprenticeship Nottingham Autumn 2023 KPMG-UnitedKingdom 3.9 Nottingham You receive a partial payment of $50 from a customer. Also, credit accounts receivable for the same amount. I'll be here to keep helping. Move suspense account entries into their designated accounts to make the suspense balance zero. There is no standard amount of time for clearing out a suspense account. Then, debit the suspense account and credit accounts payable. You can print four types of paper reports, two of which can be printed with detailed or summarized values and the other two can consist of several layouts. For example you might set up these values: Set up the Tax Areas using Suspended Tax to identify the tax areas for which to hold taxes in suspense. Also, enter the same amount with an opposite entry in another account. Procedures covering these functions should be clearly set out in desk instructions.

General LedgerA general ledger is a book of accounts that records the everyday business transactions in separate ledger accounts. Please help me I need to correct my VAT refund. program flowchart below. M3 retrieves VAT generating (VAT base amounts), VAT payable and VAT receivable amounts from the general ledger based on the definitions of the lines and columns in the VAT report template. Depending on the transaction in question, a suspense account can be an asset or liability. Planning to retire in next few years? Check out your outstanding client invoices to see which one matches the payment amount if you dont know the person who sends them. You can print the electronic report by selecting the Print option in (TXS100/B). I would like to remove a wrong Filed Tax for the months of Jan/2020 and Feb/2020. I know suspense supose to be 0 zero, but I filed wrongly because All inclusive packages for Tech Startups, including part time FD. UnderWhat can we help you with?, enter your concern about VAT returns. What Is The Difference Between The Current Ratio And Working Capital? Choose A/R-A/P (F4) to display accounting information. When you receive the full payment from the customer, debit $50 to the suspense account. To close the suspense account, credit the suspense account and debit the supplies account for the purchasing department. Gary Richards By clicking "Continue", you will leave the community and be taken to that site instead. You'll be routed into theChoose a way to connect with uspage. There may be situations that require the suspended tax accounting to be postponed. An accountant was instructed to record a significant number of journal entries written by the controller of a large company. In addition the operation and control of First, open a suspense account. Payments received with incorrect account information, insufficient instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally.